MIA > Archive > Harman

Chris Harman

Economy

Paradigm lost

(February 2000)

From Socialist Review, No.238, February 2000.

Copyright © Socialist Review.

Copied with thanks from the Socialist Review Archive at http://www.lpi.org.uk.

Marked up by Einde O’Callaghan for the Marxists’ Internet Archive.

|

How do we explain the boom in the US economy? Chris Harman examines what is happening and looks at how the bubble could burst

|

The trickle up effect

- The US economic recovery of the 1990s has only benefited the rich. By the end of the decade the average annual income of families in the top 20 percent of income distribution was $137,500 – more than ten times that of the poorest 20 percent of families, which had an average income of $13,000

- Job flexibility in California meant that in 1999 only one third of workers had a single, permanent, full-time job, and only just over one fifth have held such a job for at least three years

|

The longest continuous period of economic growth in four decades. The lowest level of unemployment since the 1970s. Stock exchange indexes twice as high as a couple of years ago. These are the facts highlighted by mainstream economists out to show that the US (and, to an only slightly lesser extent, Britain) is embarking on an unprecedented period of capitalist expansion. A ‘new economic paradigm’, they claim, means that stagnation, unemployment and inflation have been left behind.

Marxists are likely to treat any claims about the success of capitalism with scepticism, particularly when it was only 16 month ago that papers like the Financial Times were agonising about whether the Asian crisis was going to produce a ‘meltdown’ of the system. But scepticism alone is not enough. There is no denying the facts the mainstream economists point to. The US economy in particular managed to continue to grow from the early 1990s through into the new millennium in a way few people, including myself, expected.

Where we have to dissent is over the interpretation put on this growth, which obscures one central point. The growth of the US economy in recent years is markedly different to that of the long boom of the first quarter century after the Second World War.

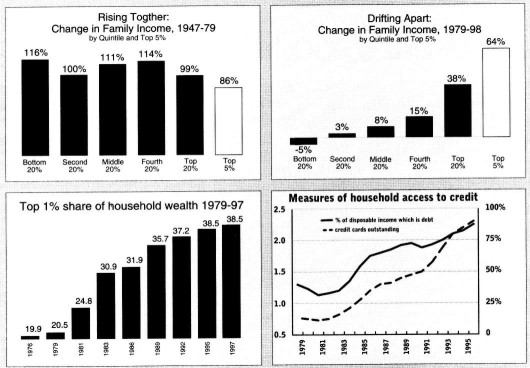

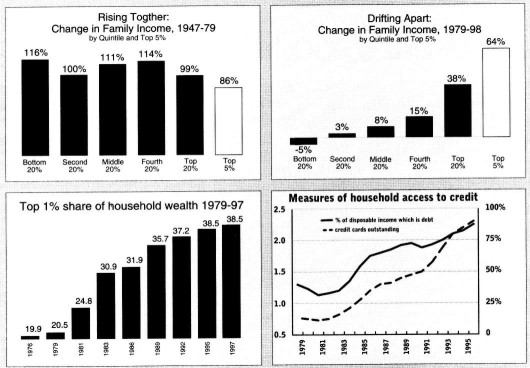

Average growth remains lower than in the early 1960s: 3.25 percent a year since 1995, as against 5.25 percent a year in the boom of the 1960s. Its impact on the living standards of the mass of Americans has been completely different, as shown by a recent study from the Economic Policy Institute. ‘Between 1947 and 1973 median family income grew ... by 104 percent ... 2.8 percent a year on average. After 1973, however, the growth rate slowed markedly. Over the 24 years from 1973 to 1997, median family income rose an average of 0.35 percent a year. On this rate it will take 198 years for family income to double’. In 1998 ‘men had a lower median income than in 1969, adjusting for inflation. If not for men and women’s increased work, families would be far worse off’. It is only in the last two years that there has been any recovery in the median wage, with growth of about 4 percent last year, taking it back to the level it was at in the late 1980s and still leaving it lower than a quarter of a century before.

The contrast is all-important. The great postwar boom transformed the lives of tens of millions of American workers, making it seem that capitalism could make people’s lives better and that the American Dream could become a reality. The boom of recent years has not had anything like that effect. In fact, it leaves one in eight Americans below the poverty line and nearly 45 million without health insurance. The fact that the top 5 percent of US families have seen a 64 percent increase in their incomes since 1979 does not in anyway mitigate the way the bottom 60 percent of US families have been running to stand still and the bottom 20 percent have slid backwards (the minimum wage in 1998 was worth about 22 percent less than in 1968).

The talk about the ‘new paradigm’ also obscures the international problems which faced capitalism throughout the 1990s. Between the end of the Second World War and the mid-1970s the whole world economy was drawn into the boom. All the advanced industrial countries grew. Many previously ‘backward’ countries (Italy, Spain, Portugal, and eastern Europe) industrialised. Even many parts of the Third World laid down a basic industrial infrastructure and saw a rise in average life expectancy. By contrast, the 1990s witnessed stagnation in what had been the world’s second largest economy (Japan), a massive decline in its one time rival for that title (Russia), and sudden crisis in the East Asian economies that had sought to emulate Japan’s past growth. The other great chunk of the world’s economy, western Europe, hovered between stagnation and slow growth throughout the decade, with unemployment levels of 10 percent and upwards.

To ignore these elements avoids coming to terms with some of the most important factors explaining the American boom, by vastly exaggerating the impact on production of the new technologies associated with the microchip and the internet.

|

|

The recent mergers between Time-Warner, EMI and the internet service provider AOL provide a prospect of homogenisation within the entertainment industry. We can look forward to more delights from the companies who brought us Sex In The City, Scooby Doo, Madonna and Cher

|

The costs of capital

Proponents of the ‘new paradigm’ claim that these technologies are producing a virtually unparalleled improvement in US productivity. If economic statistics do not bear out this claim, they retort it is because the statistics do not measure the right things. In particular, the figures do not take sufficient account of the vast advances in computer technology itself.

This argument amounts to saying that computers have massively enhanced productivity in an unmeasurable way by permitting the production of other computers. But in reality computers and computer chip applications do not themselves directly constitute more than a small portion of US output. What matters for the performance of the US economy as a whole is the degree to which they cut the cost to capitalists of producing other goods. There are substantial possibilities for cutting such costs in the long term. But they will not lead to the magical overcoming of the system’s problems.

Capitalists’ costs consist of three sorts – costs of labour, costs of fixed capital (plant and machinery) and costs of circulating capital (raw materials and components being transported or waiting to be used, finished goods stocked before being sold, marketing expenditures).

The microchip based technologies have been cutting into labour forces in many industries for a decade and more – from robots in car plants to cash machines in high streets. This, however, is not something radically new in the history of capitalism. It is simply a continuation of the pattern of capital accumulation going back to the first spinning mills in the 1770s through to the first production lines in the years before the First World War to automation in the 1950s.

What is more, as with these previous changes, the transformation in fixed capital which accompanies it is contradictory. Individual bits of machinery tend to fall in price (since they are produced by less labour), but the total costs of fixed capital grow, there tends to be more machinery and it needs replacing more often. To give a crude example, newspapers and books were typeset for most of the 20th century on mechanical equipment dependent on the use of molten lead. In the 1970s and 1980s this was replaced by computerised systems employing machines which were cheap and rapidly fell in price. But the machines needed to be replaced more often (rarely staying in use more than half a dozen years, as opposed to the half a century or more lifespan of many old typesetting machines) – and usually tended increasingly to be integrated into expensive network systems. This has been the pattern across most industries. The ratio of fixed capital to labour has grown along with the proliferation of new technologies. An interesting appendix to the most recent IMF report on the US economy bears this out. It shows that, while many of the advances in US productivity in the long boom years were ‘technologically neutral’ (ie did not depend on expensive investment in updated equipment), all the advances from the late 1970s to the late 1990s depended on ‘investment specific technical change’.

Some of the more serious attempts to show the great advantages for capitalism of the new technologies, particularly the internet, concentrate on the third element, the cost of circulating capital. What is significant here is not the much publicised growth of internet retail sales. These depend, at the end of the day, on labour intensive delivery services – the 21st century equivalent of the butcher, the baker and the candlestick maker. Like the paperless office, the labour-less retail sector is a complete myth, as people who ordered their Xmas goods by e-mail only discovered when they could not get them on time because of clogged up postal and parcel services.

Much more important are the possibilities computerised communications offer to movements within and between businesses. There are potentially enormous savings to be made when it comes to transporting and stockpiling goods. It is estimated, for instance, that 40 percent of trucks on British roads are empty after making deliveries. Computerisation offers firms the prospect of keeping track of lorry fleets so as to reduce this figure enormously. It also makes much more feasible ‘just-in-time’ methods-getting suppliers to provide components when they are needed, without having to keep expensive stockpiles. In the process many intermediary firms, who link firms to their component makers, can be carved out, to the benefit of the profitability of the final producers.

But, and it is a very big but, all these things are still very much in the future. Few firms have yet managed to implement such changes on any scale. And what is more, when they do so the transformation will not by any means be unprecedented. In the 1920s, for instance, there was enormous speeding up in the use of circulating capital. There were new and faster means of communication between firms, the first widespread deployment of long distance telephone and teleprinter systems, with an impact as least as great as those talked about now. There was also something not expected now, a massive increase in the speed of deliveries of components and raw materials as motorised trucks more or less completely replaced horse drawn vehicles. Refrigeration transformed the economics of storage of many products. The spread of electric power lines and the electric motor reduced the dependence of industry on coal and steam power, enabling light industrial production to take place closer to markets. And there was also the tapping of new mass markets with the rapid spread of radio receivers, the record player, recorded music and, in the US at least, the first mass use of motor cars.

Not surprisingly, many pro-capitalist economists responded to these astounding novelties by talking in terms of a ‘new era’, much as they talk of a ‘new paradigm’ today. This did not, however, prevent US and world capitalism falling into its worst ever slump at the end of the decade. But if the new technologies cannot explain the recent American boom, what can?

Three interrelated sets of factors have been at work.

First, during the 1980s US capitalists responded to the increased competitive challenge from Europe and especially Japan by a sustained programme of rationalisation and re-equipment. As Gerard Barker noted in the Financial Times, (13 December 1999), ‘Having grown at a steady rate of about 6 percent from 1960 to 1980, investment in producers’ durable equipment accelerated to an annual growth rate of more than 12 percent in the 1990s.’ There were times when firms like IBM, Ford and General Motors came very close to going bust – the late 1980s was the era of US paranoia about the ‘Yellow Peril’ threat to US industry. But US industry had an advantage its Japanese competitors did not – links to the world’s most powerful state via military procurement programmes. By the end of the 1990s the US had maintained or recovered its dominance in key industrial sectors – Boeing in aerospace, Microsoft in computer software, Monsanto in agribusiness. Even General Motors had restored some of its old position.

The second factor that made this possible was a crude, old fashioned and enormous increase in the rate of exploitation of American workers. The IMF report says ‘labour’s share in the national income has declined quite sharply relative to the previous cycle ... One strong development of the current expansion has been the steady decline in labour’s share of national income.’ Throughout the boom the benefits of increased productivity have gone to capital rather than its workers.

This increase in what Marx would have called ‘relative surplus value’ has been accompanied by something else. There has been an incredible increase in ‘absolute surplus value’ – the working week needed to maintain the worker’s living standard. As the authors of Divided Decade explain, ‘Mothers in married family couple families increased their average annual paid work by 223 hours – by nearly six weeks – between 1983 and 1997. Fathers increased their work by 158 hours or four weeks in the same period.’

These long working hours are as important as the level of capital investment in explaining the renewed international competitiveness of major US industries in the last decade. Output per head of population is considerably higher in the US than elsewhere – if Britain’s output per head in 1996 was 100, then France’s was 105, Germany’s 113 and the US’s 137.

But, as Samuel Brittan pointed out late last year in the Financial Times (11 November 1999), when it comes to output per hour worked, the US actually lags behind: with Britain as 100, France is 132 and Germany 129, but the US only 121. This was because the capital for each hour worked was 30 to 40 percent higher in France and Germany than in Britain, and even 15 to 20 percent more than in the US.

The American advantage can be explained by the fact that US workers work much longer than their European counterparts – 40 percent more than French workers, 29 percent more than German workers and 13 percent more than British workers. Only Japanese workers do the same 2,000 hours per year as US workers.

The US boom had depended on investment, and investment had depended on recovery of profit rates which fell sharply in the late 1970s and 1980s. The massive increase in relative and absolute surplus value enabled profit rates in the 1990s to recover to roughly the level of the early 1970s – but not to the higher level of the 1950s and 1960s.

Sustaining a boom dependent on profit rates arrived at in this way is doubly difficult. It is threatened the moment workers refuse any longer to accept the high levels of exploitation. Two years ago, when workers began to recover some of their wage losses at the time of the UPS strike, profit rates began to be dented and there was a brief turn down in manufacturing industry. Lower wage increases over the last year have restored confidence in profits. But this situation cannot last indefinitely, because for capitalists to achieve the profit levels they have expected in the past, real wages would have to be cut even more than previously.

The IMF report produces an interesting calculation. It looks at the soaring stock market index, and asks what this indicates in terms of hoped-for future profits. Its conclusion is that ‘investors’ believe their real ‘earnings’ will ‘grow by between 6.25 per cent and 7.75 percent a year’. ‘But this’, it warns, ‘would require an unrealistic sustained increase in the share of corporate profits in GNP’. So the boom is in danger unless US workers accept further massive increases in the rate of exploitation.

But the boom also faces dangers if this increase takes place. The growing output of the US economy does not only go into investment by firms. It also goes into consumption. This has continued to rise despite the low level of wage increases because of massive expansion of borrowing by ordinary Americans. Total ‘revolving credit’ – most of it credit card debts – trebled in the course of the 1990s. By 1999 total spending by American consumers was 5 percent higher than their total incomes. Much of the spending, of course, will be by the top 20 percent of the population, or even the top 5 percent. But much of the indebtedness will be among the bottom 60 percent. Cuts in their living standards on the scale needed to sustain profit rates would force them to cut back on spending in such a way as to destroy markets for many consumer goods.

America On Line?

- Between 1973 and 1998 productivity grew 46.5 percent

- The median wage fell by 8 percent

- If wages had kept rising with productivity the median wage would have been $17.27 in 1998, rather than $11.29

Divided Decade, C. Collins, C. Hartman and H. Sklar

|

Will the boom go bust?

The boom, then, is threatened from two sides. It cannot be sustained if the rate of exploitation fails to rise, leading profit rates to fall. But it is also threatened if the rise in the rate of exploitation required to keep profits up leads to a fall in workers’ real incomes.

So while most mainstream economists are obsessed with the ‘threat’ to the boom of inflation (i.e. rising wages) due to ‘tight labour markets’, others are worried that the cut in consumers’ spending required to bring it down to the level of their incomes (the so called ‘correction to negative saving’) will drive the economy into a slump. Heads or tails they lose.

The third factor in sustaining the boom is connected to this excess of personal spending over incomes, and just as precarious. It is the dependence of US capitalism on capitalists elsewhere helping it sustain its position. The recovery of the competitiveness of American industry in the 1990s was connected with the ability of the US to get its way in international negotiations from getting the prime arms contracts after the war with Iraq to imposing its version of ‘free trade’ through the long drawn out negotiations which led to the setting up of the World Trade Organisation; from protecting the profits of its banks through its domination of the IMF and the World Bank to persuading Japan and the European powers to accept exchange rates for the dollar that increased the competitive of American goods.

Even so, US imports have been growing more rapidly than US exports. The deficit on America’s current balance of payments has risen from around zero in 1991 to over 3 percent in 1999. US capitalism has been able to cope with the deficit because there has been a vast and continuing inflow of lending to firms and banks, and through them to consumers, from other major economies. In the early 1990s the biggest source of the lending was Japan. More recently the European component has grown to match the Japanese one – a reflection of the way in which the European economies have stagnated and investors have hoped for higher profits in the US. It is this lending which has enabled US consumption to continue to rise, despite stagnating real wages, and US industrial investment to exceed the ‘saved’ part of firms’ profits. According to the IMF report, ‘the proportion of gross savings in the rest of the world’ absorbed by ‘the US current account deficit ... has risen sharply since 1997. It reached 4.5 percent in 1998’ and was ‘envisaged to increase further to about 5.5 to 6 percent in 1999’.

|

|

What in effect has been happening is that capitalists across the world have feared for the prospects for profits in their own countries and have instead put their faith in raking in money from the American boom. So far this has been a self fulfilling prophecy. As they have poured money into buying on the American stock exchanges, they have driven share prices ever higher, enabling financial institutions and rich people throughout the world to make enormous paper profits – and in some cases to turn these into hard cash. The scale of these profits has caused even those financial institutions which are sceptical about the boom lasting to take short term bets on a further rise in share values, lest they lose out to their competitors. As some of these profits have accrued to American capitalists and better off sections of the American middle class, they have given a further boost to the growth of both industrial investment and consumption in the US.

Those mainstream economists who dare to look beneath the surface appearance of the boom are, however, horrified by what they see. They point out that the stock exchange boom has lost all contact with the real profitability of US industry. The ratio of share prices to profits has historically been around 15 to 1 in the US. In the last ten years it has risen to 35 to 1. This is not because capitalists have got less greedy for profits, but because they are so carried away by their own hype that they think the profits are magically going to rise. When these illusions are not fulfilled, the stock exchange, and probably the economy as whole, can only crash disastrously.

Samuel Brittan writes in the Financial Times of a ‘macroeconomic time bomb ticking away’. Wynne Godley and Bill Martin warn of a ‘shock’ that could ‘easily overwhelm policy makers’ attempts at stabilisation’. The Bank of International Settlements ‘finds cause for concern in the world’s reliance on continuing US growth ... Both the dollar and Wall Street are vulnerable to a sharp fall’. Even the IMF has doubts, drawing attention to ‘concern about a bubble in the market and the potentially adverse consequences for the economy in the event that such a bubble bursts’.

Many mainstream economists dismiss such warnings, claiming that the absence of significant inflationary pressures in the US economy means that this boom will not lead to a slump. They lack memory as well as foresight. Once a bubble exists, there are all sorts of things other than inflation that can burst it. The most famous crash in history, that of 1929, followed a period in which prices showed no overall rise at all, although shares and property value leapt upward – much as at present. No one can foresee exactly how the next crash will occur, or the scale of its impact on the world economy. What is clear, however, is that the long period of crises we have been through since the mid-1970s is far from over. The world’s biggest economy cannot evade forever the sorts of problems that beset its rivals in the 1990s. And that will have enormous political and ideological as well as economic consequences.>

Top of the page

Last updated on 22 December 2009